In this review of the Marcus by Goldman Sachs Savings bank, we will discuss multiple things. It’s important to have a short history of Goldman Sachs and how Marcus started. Also, we will go into the general structure of the savings account offered, including some pros and cons, then of course I will give you my final take on using this option as alternative to your everyday bank for storing cash.

When you think of Goldman Sachs, possibly the thought of high-end investors comes to mind. We may dismiss any account by Goldman Sachs as being beyond our reach. However, the relatively new Marcus savings account changes all that, with an account that does not require a minimum investment or minimum balance. Opening an account is simple and you simply fund it anytime within the first 60 days, and that’s it.

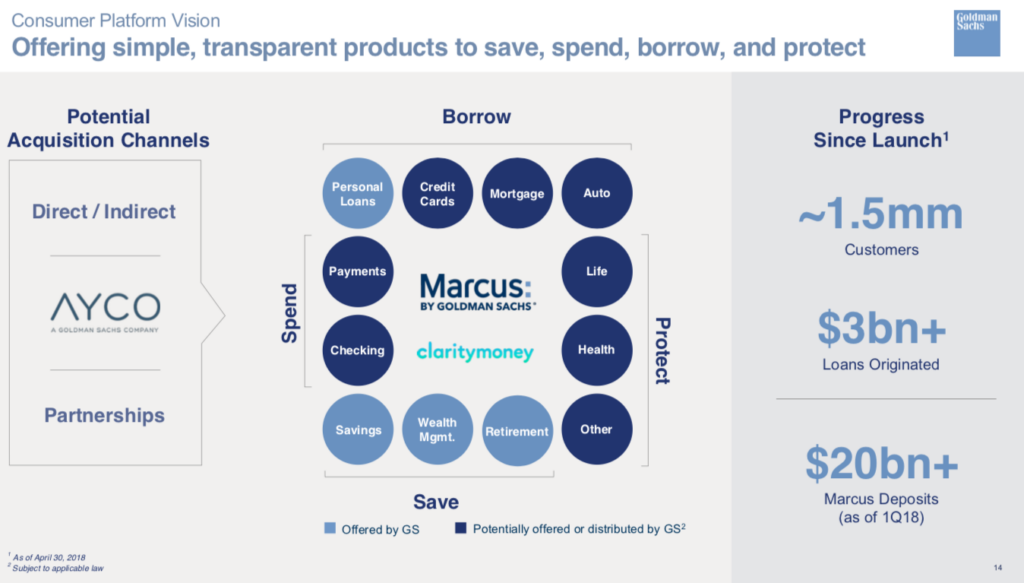

Goldman Sachs is one of the world’s largest investment banking companies. The company was formed in 1869 by Marcus Goldman and is headquartered in New York. It also has other offices in major financial centers. Goldman Sachs Bank USA is a direct bank serving customers directly through online accounts.

As a Direct Bank, the everyday costs of Goldman Sachs Bank are significantly reduced, making it possible to offer far more competitive banking products. Very few people tend to use bricks and mortar facilities, even when banks offer them. Online banking is far more convenient.

Marcus

For this review of Marcus by Goldman Sachs, we should give some background on the Marcus account. It was created in 2016 and immediately made Goldman Sachs much more accessible to the general public.

Important aspects of the Marcus account are that it carries no fees, and offers a competitive 0.50% APY, putting the account in a strong position against the competition.

No monthly maintenance fees and no transfer fees are a refreshing change in this environment. It is especially unusual to find what people typically regard as a high-end bank is reaching out to a broader marketplace.

Your Marcus account is FDIC insured. The FDIC limit is $250,000, so you are protected from market vagaries. Most accounts offer this same coverage.

Saving

The Marcus account, like any savings account, is a wise choice. However, the Marcus account helps you get into the habit of saving by allowing you to set up automatic transfers so that you cannot be distracted and forget to make your deposit. Successful saving needs to be a seamless process where money just moves from one account into another without taking any action.

Most savings accounts do not to allow too many transfers each month. They are not intended as accounts from which you make transactions, they exist to allow you to put aside money for the longer term. Marcus has a generous monthly allowance of six transactions, including deposits and withdrawals. This should be more than enough for somebody who is using the account correctly. The good news is that instead of allowing extra transactions to go through, and then hitting you with fees, they put a hold on the transaction.

An excellent feature is that you can transfer $125,000 online and unlimited transfers if you call first.

Disclaimer: I receive affiliate compensation for some of the links in this post at NO cost to you. However, these are the best tools I have used and tested that I believe are most effective for launching and running an online business. You can read our full affiliate disclosure in our privacy policy.

Pros & Cons (Review of Marcus by Goldman Sachs)

For the purposes of this review of Marcus by Goldman Sachs, we will offer some general pros and cons versus any direct comparison against another bank. The intent here is not to place one bank as better than the other, but simply to offer options that are available to you as an informed investor.

Pros

1. Excellent interest rates

2. Live (USA Based) Call center staff during office hours

3. No Monthly Maintenance Fee

4. No Minimum Balance

Cons

1. No Mobile deposit for checks (they have to be mailed in)

2. No ATM Card available with this account

3. No physical branches for banking transactions

Deposits and Withdrawals (Review of Marcus By Goldman Sachs)

Since this is a saving account, rather than a current account, the convenience of paying in and withdrawing may not be quite as important, but it is still worth considering.

You can make deposits into your Marcus account using one of the following methods.

1. Free Electronic funds transfer

2. Free Direct deposit

3. Free Wire transfer

4. Check posted to the office (will cost you a stamp and an envelope)

There are two ways to withdraw funds from your Marcus account. Remember, in common with most other savings accounts only six withdrawals are possible per month.

1. Electronic Transfer

2. Wire Transfer

My Final Take (Review of Marcus by Goldman Sachs)

The Goldman Sachs Marcus account offers excellent rates of interest, comparing a couple of competitive accounts we see:

Marcus Account 0.5% APY

CIT Bank Savings Builder 0.4% APY

American Express High Yield 0.4% APY

Of course, as an online-only bank, you have no branches to visit, but that does not bother many people. More importantly, is that you do not have an ATM facility.

The other major factor that might appeal is the “No minimum balance” which is also offered by American Express, but not CIT Bank who requires a $25K deposit/$100K per month. The Marcus account is certainly worth consideration. I have another great article just on general savings techniques in my post on ‘Investing and Savings‘.

It’s plain to see that if you are comparing just general savings accounts, this appears to have many positive aspects that don’t exist with other banks. Keep in mind that interest rates offered are always subject to change. Please don’t make an investing decision based solely upon the interest rates at the time. My impression is that Goldman Sachs is offering the Marcus savings account to attract new investors for their financial products. Which, in and of itself is not a bad thing, I would simply suggest that there may be future strings attached. If you have a desire to invest with Goldman Sachs, then by all means feel free to utilize this savings account. If you are curious about another option, please check out my review of Chime Bank. It could fill your needs better.

Before you go…

I would always suggest, however that there are four asset classes and Goldman Sachs may be able to offer several, but ultimately to achieve true financial freedom and long term wealth, we need to have a side business of some kind.

Have ever considered a side business where you can devote at least 30 minutes per day and achieve lasting success? The program below helped me get started. It will teach you everything you need to know to be successful with a digital business. This is the same program that has allowed me the freedom to work for myself full time. You can start a business easier than you think, but it requires help and education to make good money.

Partner up with me by clicking on this link and watching the video.

We will show you EXACTLY how to build a business online and customize a plan just for you. We will help you choose a niche, setup your online business and help with selecting offers that you can promote.

On top of that you will get ONE on ONE mentoring to make sure you are doing things right.

A great way to be able to save more money is when we make more money.

Cheers to your success and See you at the Top!

-Cameron